Aptos Price (APT), a Layer 1 Proof-of-Stake (PoS) blockchain, is gaining momentum, reflecting a strong bullish trend. Since the U.S. elections, The token has surged alongside other cryptocurrencies, standing out as one of the top-performing tokens in recent days. Currently positioned for a potential breakout, Aptos appears set to challenge the $20 mark, which could push it to new all-time highs, particularly following Bitwise’s announcement of its upcoming ETF launch.

Aptos Price Eyes $20 on Bitwise ETF Launch

Aptos price anticipates a surge, potentially reaching $20, as Bitwise announces its Aptos ETF launch in Switzerland. Bitwise, a major player in asset management, plans to list this ETF on Switzerland’s primary stock exchange, SIX, enhancing its credibility and appeal.

The Aptos ETF will include staking capabilities, giving investors additional benefits. With this launch, Aptos strengthens its position in the crypto space, attracting traditional and digital asset investors.

This move by Bitwise reflects the growing interest in Aptos and aligns with Switzerland’s supportive crypto regulations. Many anticipate this ETF listing will drive top altcoins to new price levels.

BREAKING

@BitwiseInvest , one of the world’s largest asset management companies, will launch the @Aptos ETF in Switzerland. #ETF will also support staking. The fund will be listed on SIX, Switzerland’s major stock exchange#Aptos #tether #USDT@moshaikhs pic.twitter.com/vSbkNAms4G

— Jᖇ𝓞𝒇𝓕’𝔁 | ᴀᴘᴛos (@jroffx) November 12, 2024

APT Price Soars Amid Bullish Momentum

The Aptos price has spiked by an impressive 50% within the past week, driven by renewed market interest and favorable market conditions.

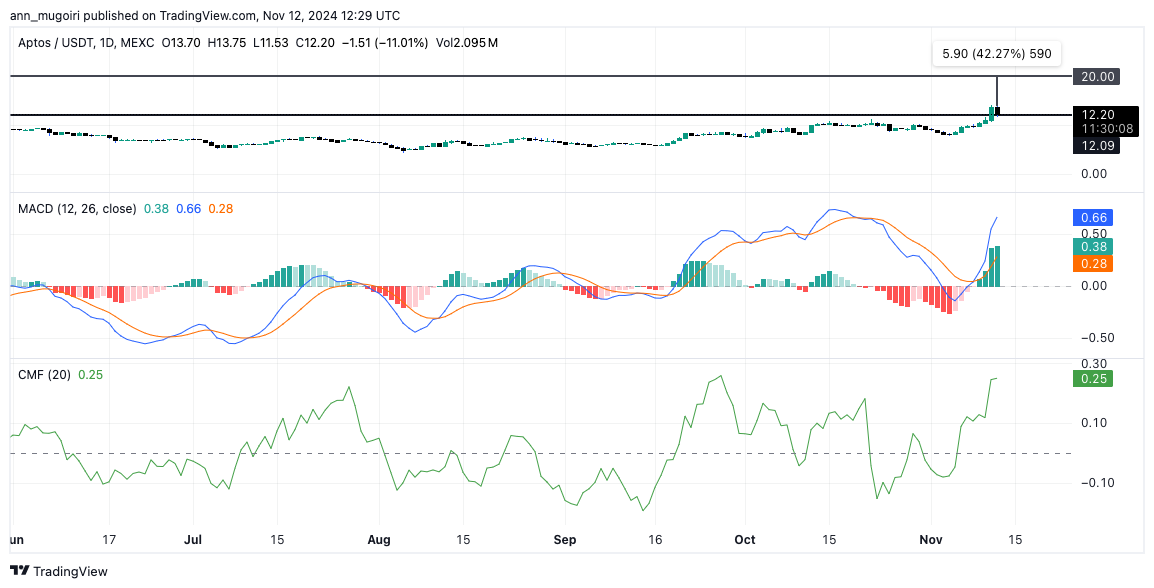

At the time of writing, the latest APT price hovers at $12.25, marking a daily increase of 8%. This recent rally reflects the cryptocurrency’s growing momentum in the market, with Aptos recovering significantly from its previous low of $3.09, recorded on December 30, 2022. Aptos now stands approximately 308% above that low, underscoring a strong upward trend despite its historical high of $19.90 in January 2023, which is still 36% away from current levels.

The Aptos price over the past 24 hours reveals steady growth, with peaks reaching up to $13.99 before slightly retreating. If Aptos maintains this upward momentum, price targets of $15 and even $20 may become achievable in the near term. This aligns with positive market sentiment and increased trading volumes.

Technical indicators present a promising outlook. The Moving Average Convergence Divergence (MACD) indicator has flipped into positive territory, indicating bullish momentum. The MACD line remains above the signal line, indicating upward strength in Aptos’s price action. The Chaikin Money Flow (CMF) indicator, showing a positive value of 0.25, signals strong buying pressure in the market.

Aptos is demonstrating strong potential amid the bullish market, driven by the upcoming Bitwise ETF launch. Key technical indicators show sustained buying interest and upward momentum. If Aptos continues this trend, reaching $20 soon could be achievable.

The post Aptos Price Poised for $20 Following Bitwise ETF Launch Announcement appeared first on CoinGape.