Chainlink price boasts 13% gains over the last week after soaring to a high of $15.2. The asset has since retraced 10.4% and is trading at $13.37, following Bitcoin’s pullback. This decline, however, is not blindsiding LINK bulls, as they have added $165 million worth of tokens over the past week. Could LINK whales be preparing for a 100% surge in price?

Chainlink Whales Add $165M Bullish Signal For Chainlink Price?

Data from Santiment shows Chainlink whales have accumulated over 15 million LINK over the past two months, valued at around $165 million. This increased demand has likely contributed to the recent price surge of LINK, which has climbed by as much as 13%.

This kind of large investor activity often signals strong confidence in a crypto asset’s potential, which can attract more investors and drive the price up further. Coingecko data shows that Chainlink’s trading volume has been up 5% in the last 24 hours, signaling that investors are once more getting ready to push Chainlink higher after the pullback.

Breaking Resistance: Will LINK Price Double From Here?

Chainlink price has broken out of a prolonged descending triangle pattern, indicating a potential trend reversal from bearish to bullish. A clean breakout above the resistance zone around $13 suggests a new upward trend could be underway, provided the breakout holds.

The most recent breakout candle shows strong bullish momentum, with a long body breaking above resistance. This is a positive signal indicating that buyers are in control.

The breakout from the descending triangle pattern implies an 87% upside target of around $25.30, which is measured by projecting the height of the triangle from the breakout point. This move could begin a new impulse wave, especially if LINK price action establishes higher highs and lows.

LINK Price Outlook: Can Chainlink Sustain Momentum for a 100% Surge?

On the way up, the Chainlink price forecast shows immediate resistance of around $15.34 (a recent high). Beyond that, the major resistance is $22.87, which aligns with a previous yearly peak.

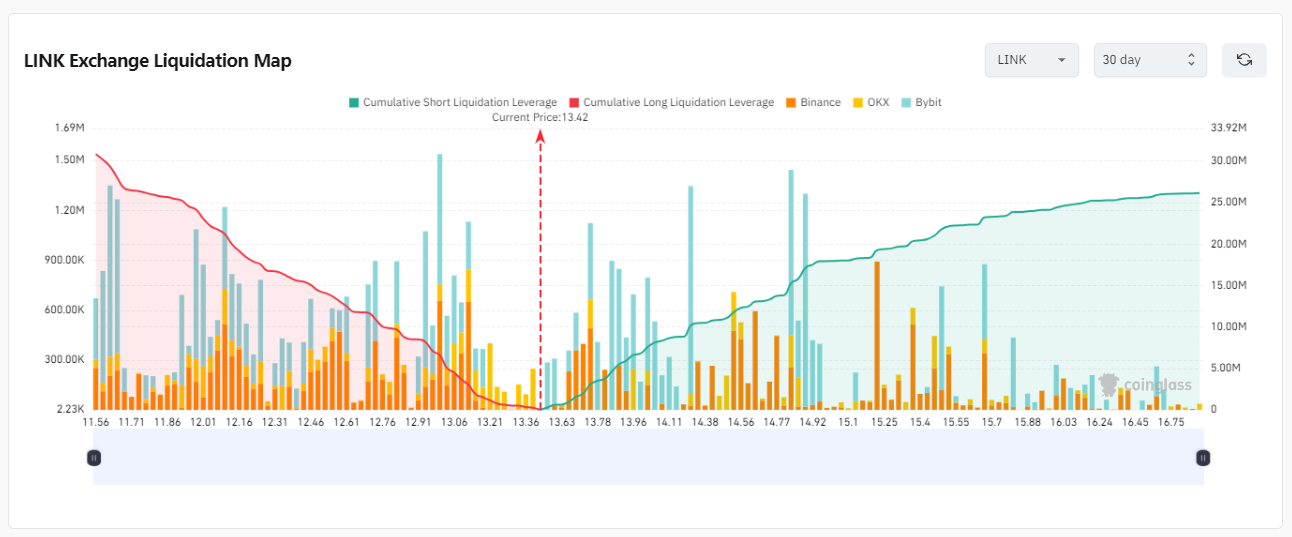

The LINK exchange liquidation map on Coinglass shows that more long traders are long on LINK than short traders. Over the last week, derivative traders have opened $30.84 million long positions compared to $26 million Shorts. This imbalance suggests that traders re bullish on Chainlink price as they anticipate it may surge higher.

Looking deeper into the Liquidation Map, there are several support zones at $11.86 and $12.46, with the heaviest being at $13.06. This latter corresponds with a key support level for the LINK identified on the price chart, around $13.

This level should ideally hold as support to confirm the breakout. If bears push the price lower, Chainlink should find further support near $10.50, in line with the descending triangle’s lower trendline.

The post Is Chainlink Price About To Soar 100%? Bulls Scoop $165M LINK appeared first on CoinGape.