TRON price is hugging all-time high price after soaring on November 13 and hitting $0.1825. Since then the asset has retraced to its current price of $0.1813. The daily trading volume has dropped 46% which shows a recent fall in market activity, potentially due to profit-taking. Can TRX price beat the current resistance and rise 800% before end of the year?

Whale Activity on the Rise: What Does It Mean for TRON Price?

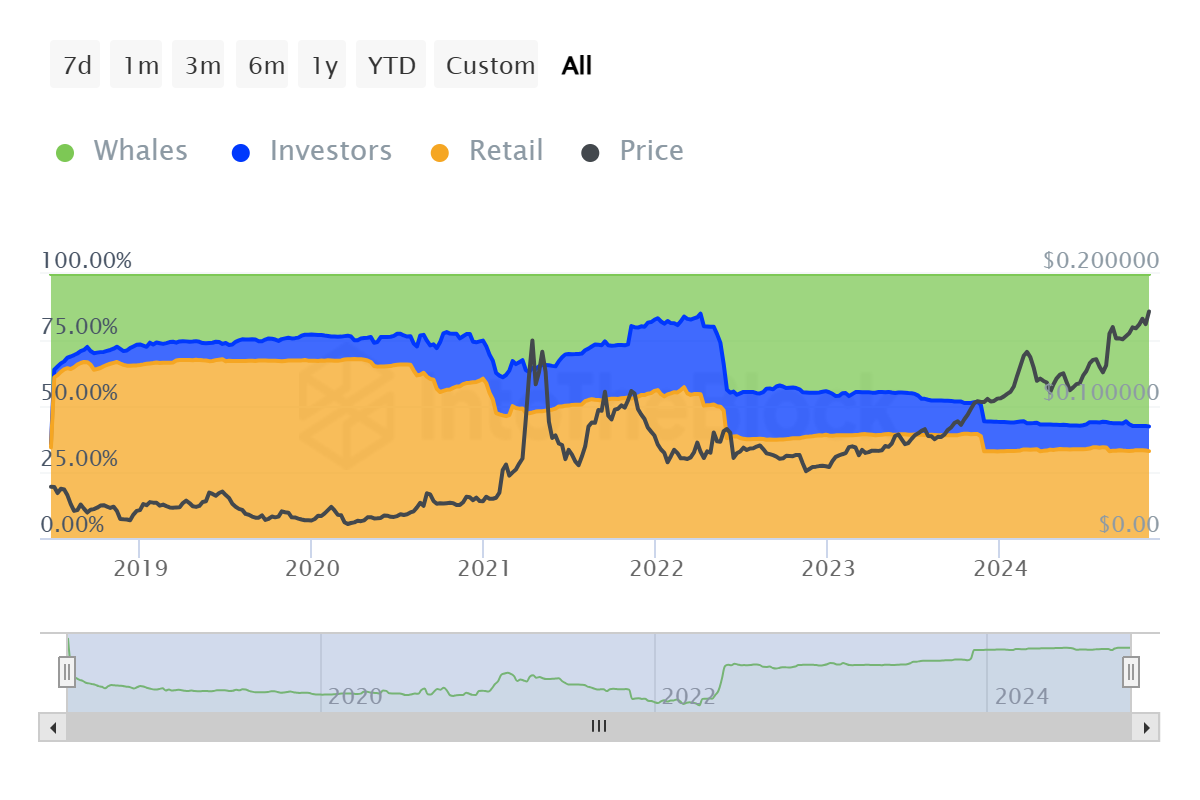

Data from IntoTheBlock (ITB) shows TRX whale activity increased over the last 24 hours. Large investors TRX inflow surged b 458% in the past 7 days, signaling that whales are accumulating the token in preparation for an surge soon.

Additionally, the overall distribution of TRX among whales also increased by 0.23% in the last 30 days. Investors concentration also increased by 1.19% while retail traders dropped by 1.74%. This metrics suggest that longer-term holders are entering the TRX market as they anticipate price will continue in an uptrend for the foreseeable future.

Crypto analyst Petrov has predicted that TRX price could rise to $1.5 by may 2025 as it has entered a parabolic curve. This assessment lines up with the TRON technical analysis that suggests an 800% move is imminent.

Crypto analyst Petrov has predicted that TRX price could rise to $1.5 by may 2025 as it has entered a parabolic curve. This assessment lines up with the TRON technical analysis that suggests an 800% move is imminent.

TRON Price Analysis: Can TRX Hit an 800% Surge?

TRX price chart shows a long-term bullish trend. A bullish pennant pattern is observed, which has broken to the upside, signaling a continuation of the prior uptrend. The price is trading within an upward sloping channel, indicating a controlled and steady bullish climb.

The breakout from the bullish pennant is a significant technical indicator, suggesting a continuation of the prior uptrend.

Based on wave analysis, this pattern suggests a possible impulsive wave structure with higher targets aligned with the Fibonacci extensions. The final target near $1.681 aligns with an extended wave 3 in Elliott Wave theory.

Recent candlesticks show steady bullish momentum, with consistent higher closes within the upward channel, indicating sustained buying pressure without excessive volatility.

TRON price forecast shows immediate resistance levels are at $0.228 (Fibonacci -0.27 level) and $0.288 (Fibonacci -0.618 extension level) with a major resistance at $0.462 (Fibonacci -1.618 extension level). The bull pennant target is set at $1.68, which is a long-term upside target based on the height of the pennant formation comprising an 800% surge from current price.

Conversely, there is immediate support is at $0.181, which coincides with the current price level and the lower boundary of the upward channel. Below this there is a stronger support around $0.044 which coincides with the Fibonacci 0.786 retracement level from previous lows.

The post TRON Price Targets 800% Surge As Whale Activity Spikes appeared first on CoinGape.