Terra Luna Classic price has remained under pressure in the past few days, as it retreated by 10.95% from its highest level this week. LUNC, the remnant of the collapsed Terra network, was trading at the psychologically important support level at $0.00010. One analyst believes that the token could stage a strong comeback and surge by at least 480% soon.

Crypto Analyst Delivers A Bullish Terra Luna Classic Price Forecast

Terra Luna Classic has lagged behind some popular cryptocurrencies like Bitcoin and Solana which have more than doubled this year. It remains in a deep bear market after falling by over 60% from its highest level this year as demand weakened.

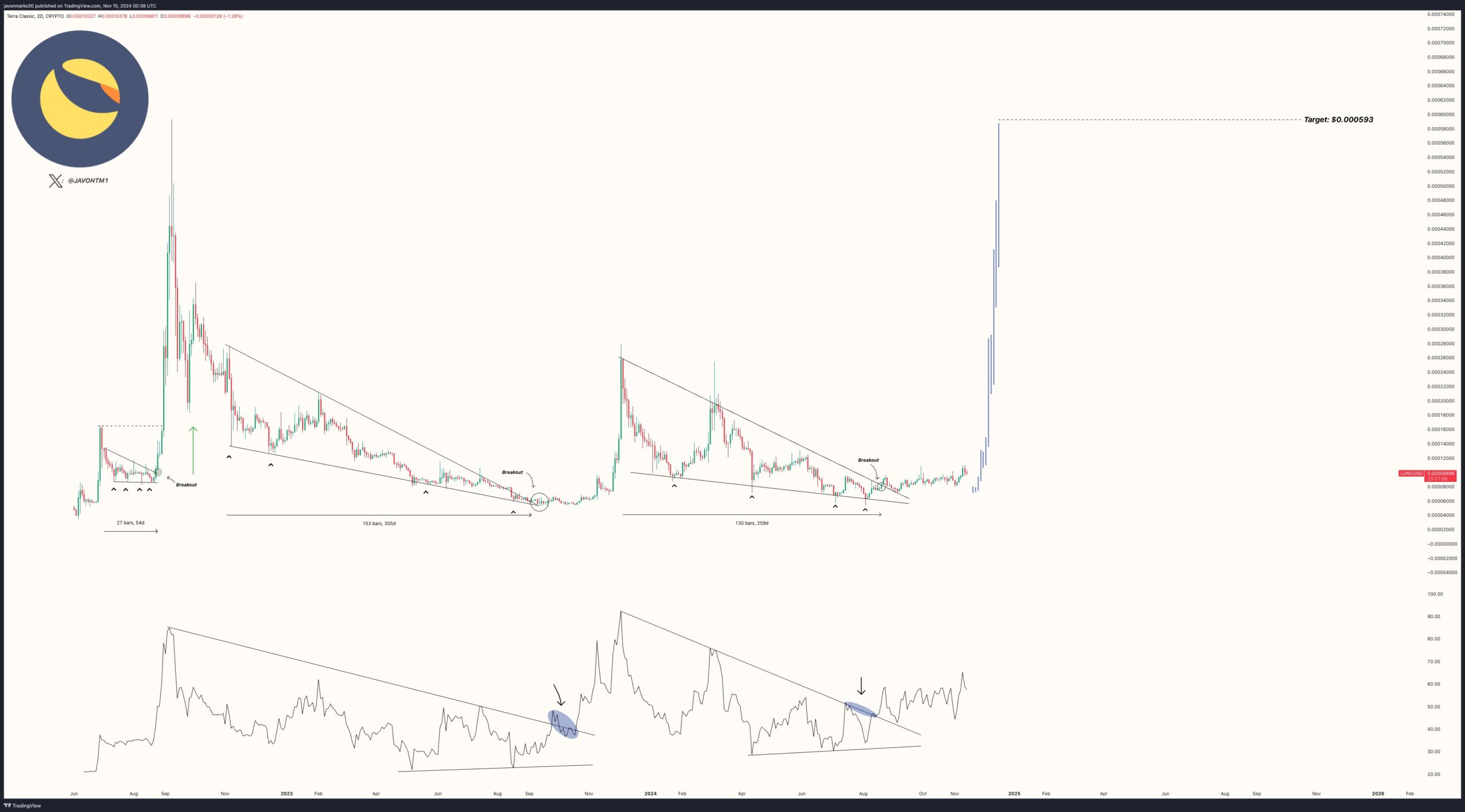

Nonetheless, Javon Marks, a popular crypto analyst with a good track record of crypto forecasts, believes that LUNC price has more room to run. He believes that it could jump to $0.000593, approximately 480% higher than the current level.

His case is based on Terra Luna Classic’s past performance and its falling wedge patterns. Over time, the coin has formed three major wedges, which all result in a major bullish breakout. If this one happens, he expects that the coin could retest $0.000593, a few points below its all-time high of $0.000064.

A falling wedge is a chart pattern characterized by two falling converging trendlines. In most cases, a bullish breakout happens when the two lines are nearing their convergence.

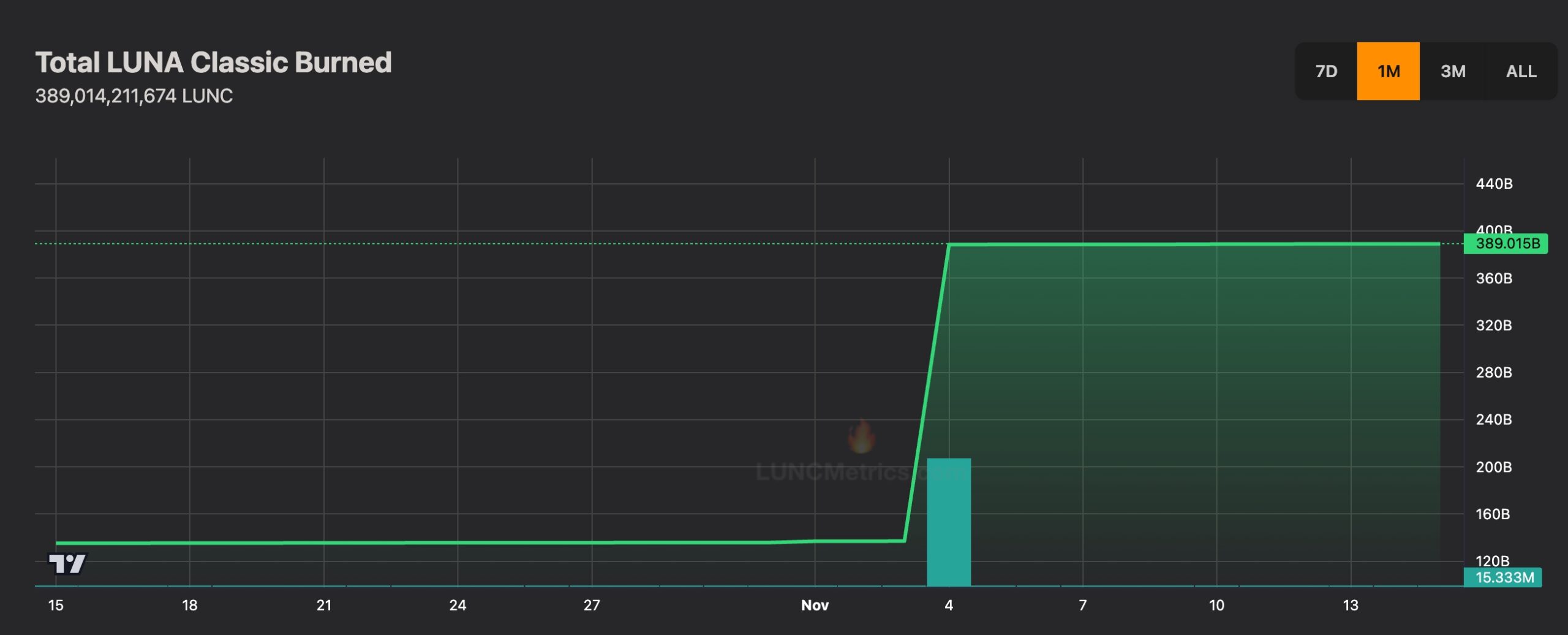

LUNC price has two potential catalysts that could push it higher. First, data shows that the Terra Luna Classic burn rate is increasing. Over 389 billion LUNC tokens have been burned since its inception. The big jump shown below happened when Terraform Labs closed the Shuttle Bridge as part of its bankruptcy settlement. Second, it will do well if the bullish breakout in the crypto industry continues.

LUNC Technicals Point To More Gains

Terra Luna Classic’s technicals are supportive of a strong bullish breakout. On the daily chart, it has formed an ascending regression channel and is being supported by the 50-day and 100-day moving averages.

The coin’s Market Value to Realized Value (MVRV) Z-score has moved to about 2.7 and is near its highest level since April. While this could be a sign that it is overvalued, it still has more room to hit $4.6, its highest level this year.

More upside will be confirmed if the LUNC price rises above the upper side of the ascending channel at $0.00010. If this happens, it will point to more gains to $0.00013, its highest level on May 30, and 33% higher than the current level.

The invalidation point of the bullish view is at $0.000085, the lower level of the channel. A drop below that point could signal a drop to $0.000053.

The post Analysts Sees Terra Luna Classic Price Surging 480% as Burn Rate Rises appeared first on CoinGape.