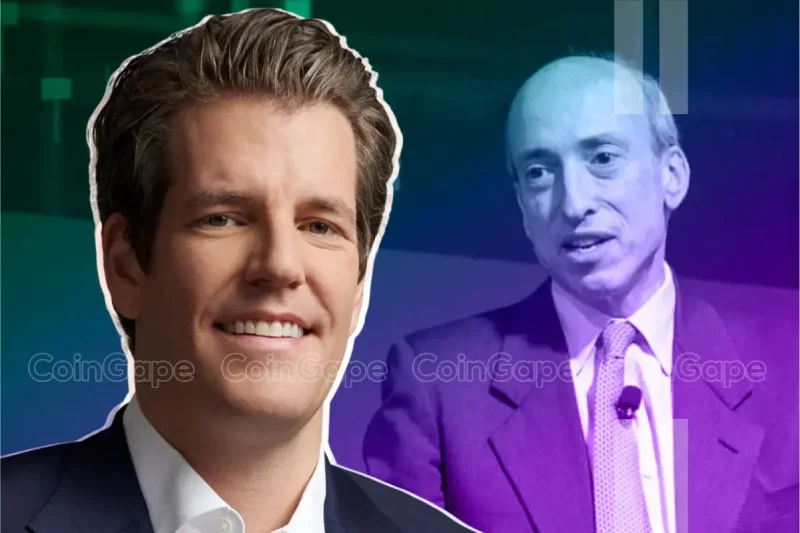

Gary Gensler is widely popular in the crypto industry but for the wrong reasons, which Tyler Winklevoss recently shed light on. Over the years, the SEC (U.S. Securities and Exchange Commission), under his power, has charged 104 enforcement actions against crypto service providers. This has been a concern for business owners and investors over the future of this industry.

However, these enforcement actions are not limited to just constraints. These businesses have spent $429 Million and hundreds of hours battling the legal limitations the SEC implemented. With that, the Gemini-Co-founder, Tyler Winklevoss, has openly criticized Gary after the industry demanded his resignation.

Tyler Winklevoss Says Gary Gensler Is Evil

Amid the public’s criticism and John Reed’s ask for Gary’s resignation, Tyler Winklevoss recently presented his views on the same. In a recent x post, Tyler claimed that Gary has caused immense damage to the industry, which is irreversible.

Tyler Winklevoss openly said that, “Gary Gensler is evil,” and that he should not have any influential or powerful position. Even the companies or universities associated with him or the SEC are actually betraying the crypto industry. With his X post on November 15, he asked to boycott such companies and businesses as that is the only way to prevent the misuse of power.

Let’s all be clear on one thing. @GaryGensler is evil. He should never again have a position of influence, power, or consequence. Any company, university, or organization that hires or works with him post-SEC is betraying the crypto industry and should be boycotted aggressively.…

— Tyler Winklevoss (@tyler) November 16, 2024

Similarly, 18 US States sued Sec for constitutional overreach in crypto regulation, clearly indicating that tension is building among the state and federal authorities. Meanwhile, Donald Trump is also on the lookout for pro-crypto candidates, per his promise before the election. However, there are still many barriers, including Gary’s threat of a lawsuit against Trump.

Moreover, even if Gary Gensler gets replaced, the damage has been done. Tyler Winklevoss has presented his views on the same, stating that “Gensler’s behavior can’t be explained away as a good-faith mistake.” As per him, whatever Gensler has done is entirely intentional to fulfill his personal and political agenda, and no apology can undo the damages.

“No amount of apology can undo the damage he has done to our industry and our country. This type of person has no place at any institution, big or small. “

Will Gary Gensler Resign From the SEC Chair Position?

Gary Gensler has been the SEC Chair since 2021 and will complete his term in 2026. However, for the last few days, rumors have been circulating about his early resignation. Many sources even claim that he is likely to announce his resignation around Thanksgiving or before Trump’s inauguration in January.

Even the XRP attorney James Murphy has shared his insights regarding the same. He pointed out that there is a common pattern where the SEC chair resigns near a new presidential administration. Jay Clayton’s resignation in 2020 and Mary Jo White’s in 2016 are the biggest supporting points behind that analogy. Additionally, Trump began selecting pro-crypto candidates, further pointing to the possibility of resignation.

More importantly, during the PLI’s 56th Annual Institute on Securities Regulation earlier, Gensler spoke on various topics. However, what stood out was his closure of the speech, which many interpreted as a hint for his potential resignation. During the speech. he said,

“It’s been a great honor to serve with them, doing the people’s work and ensuring that our capital markets remain the best in the world.”

Crypto Market Booming With Gary’s Resignation News

Amid the anticipation of Gary’s resignation, the crypto market has already begun splurging. Many cryptocurrencies, including the XRP price rallied, gaining a 75% surge over the week. This is one of the biggest surges for this crypto token, as it has been facing a downtrend for years, currently trading at a three-year high of $1.05.

Moreover, many analysts foresee a bigger rally considering investors’ negative sentiments around Gary Gensler. Almost every crypto enthusiast agrees with Tyler Winklevoss’s claim that Gary has done unrecoverable damage, but Gary believes that what he has done is amid regulatory needs. And that the majority of cryptocurrencies today lack any proper use case, calling the need for stricter enforcement.

The post Why does Gemini’s Tyler Winklevoss Call Gary Gensler Pure Evil & Unforgivable? appeared first on CoinGape.