Solana price soared to an intra-day high of $244.56 on November 18 before dropping to $230.98 on the same day. The increase coincided with its market dominance soaring to new all-time high, suggesting growing investor confidence, which could lead to increased demand for SOL, potentially driving the price higher.

At press time, the SOL price is trading at $242.91, up 2.6% in the last 24 hours. The price of SOL is just inches away from its previous all-time high, and market observers wonder how high it could soar 100% after clearing this barrier.

Solana Market Dominance Breaks New ATH

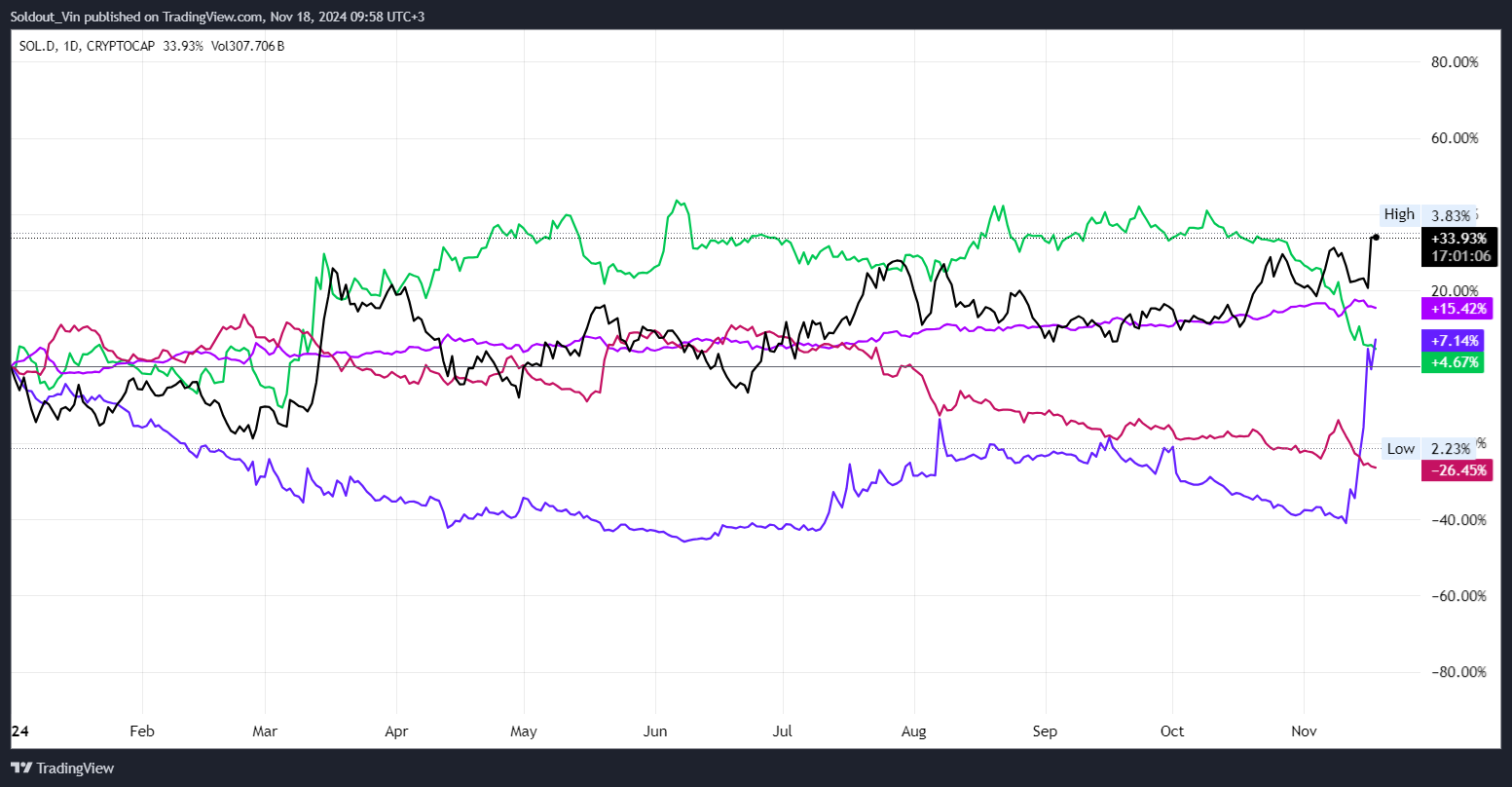

Data from Tradingview shows Solana market dominance has rallied to a new all-time high of 3.83%, which indicates the network is growing and taking on a larger share of the market. In comparison to the top 5 crypto assets by market cap, Solana performed the best year-to-date, gaining 33% in its market dominance from a yearly low of 2.23% MD. Ethereum was the worst performer as its market share has dropped 26.45%.

One of the main factors contributing to the surge in market dominance is the cheap transaction fees on Solana and the fast execution. This efficiency has enabled meme coin mania to thrive on the chain, drawing liquidity from Ethereum.

Solana Price Analysis: Breakout or Top Signal?

Solana price forecast shows the L1 chain had a strong upward breakout following the breach of the supply zone around $210–$245. This indicates a shift from consolidation to bullish momentum. The asset has established a new higher high, affirming the continuation of the bullish trend.

There was a significant increase during the breakout, confirming strong interest in the current price movement. The relative strength index (RSI) indicates overbought conditions, which means Solana price will likely face a brief consolidation or pullback near resistance.

The most immediate resistance level for SOL price is $245, which coincides with the 0.618 Fibonacci extension. Beyond that, Solana is poised to surge to $345.

Conversely, if the bears push the price lower, the SOL price may find support around $210, the previous resistance-turned-support.

Can SOL Price Sustain Momentum for Further Gains?

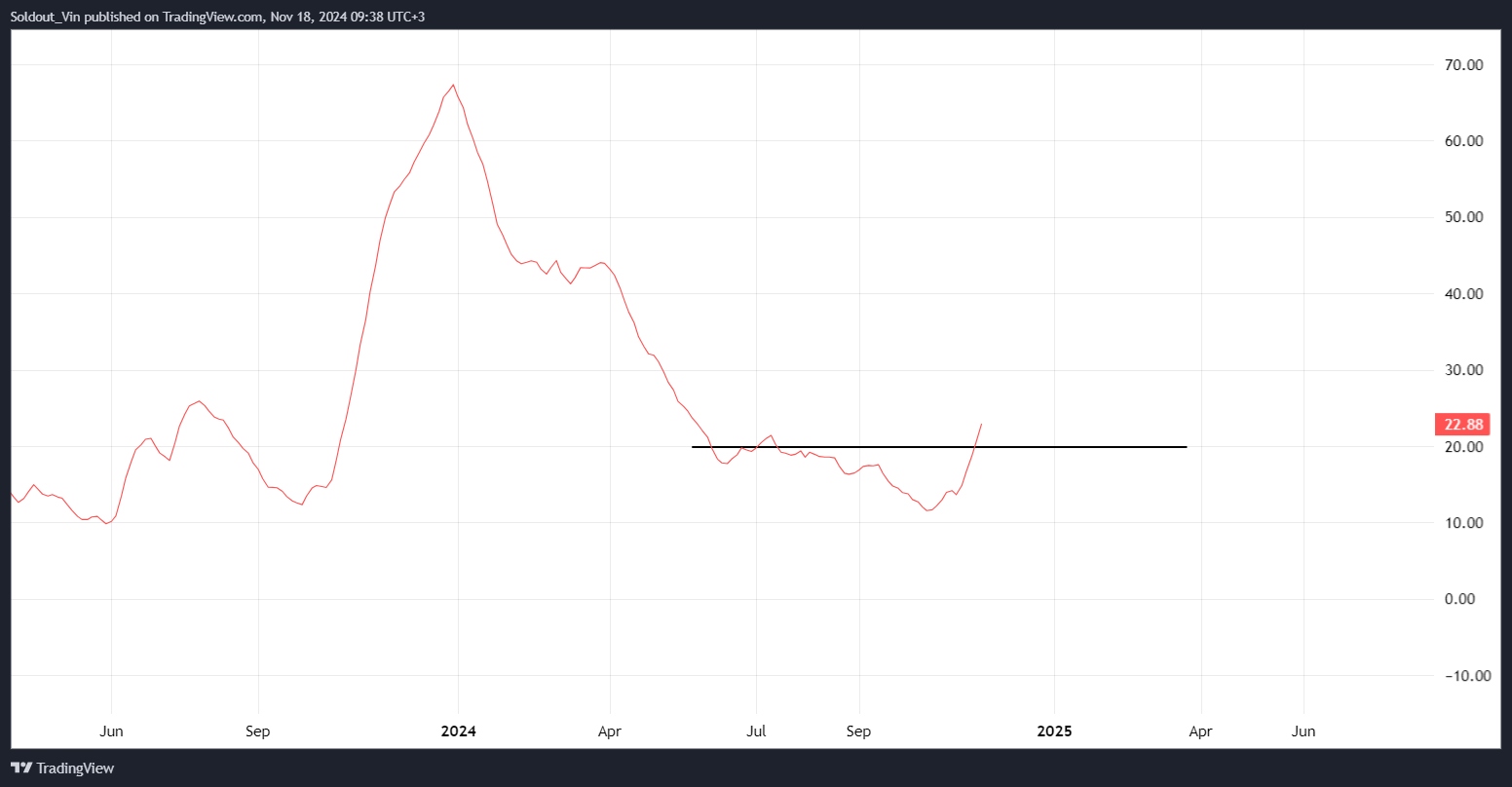

Solana’s average directional index (ADX) just broke above a key resistance level (20), suggesting that the crypto asset’s volatility has risen to new levels. The last volatility that rose past this point was during the March mini-bull run. This could be a signal that the Solana rally is only just beginning.

Crypto analyst Bagsy also pointed out that Solana could repeat Ethereum’s performance in 2020, which soared 3.14X after breaking its 2017 high. The analyst predicts that Solana could soar by the same or more percentage if it clears $248, its previous (2021) all-time high.

The post Will Solana Price Double As Dominance Soars to New ATH? appeared first on CoinGape.