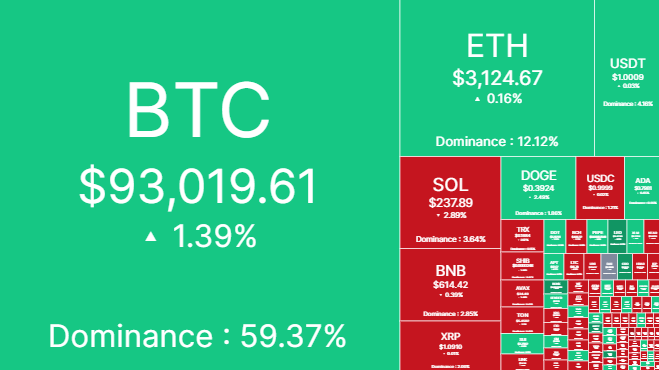

The crypto market is in its prime, where many cryptos have achieved new highs, beating the bear’s dominance. More importantly, Bitcoin price has doubled over this period, creating an all-time high of $94,002.87 just a few hours ago. However, today, the market is hit with a sharp downturn instead of a continuous upsurge, confirming the rising volatility. Though this is a part of the industry, many broader market movements and geopolitical situations are to blame.

Why is The Crypto Market Down Today?

Despite Bitcoin hitting an all-time high, it has already moved away from that, currently trading at $93K. This has happened with the traders losing confidence, as there is a 2% drop in the trading volume, which has impacted the entire cryptocurrency market. The global market capitalization has backed down to $3.08T, with a 9% drop in global trading volume, currently at $ 180.87 billion.

Additionally, the crypto market heatmap represents all the major altcoins in red, signifying a downtrend and shift in the user’s sentiments.

1. Bitcoin FOMO and Consolidation

In YTD, the Bitcoin price has surged 118%, which is impressive. Out of this, the 23% surge has happened in the last two weeks, thanks to Donald Trump’s victory in the US elections. Interestingly, the BTC price began to surge even before that, as investors were bullish about Trump. With that, it has created multiple highs in the last two weeks, drawing the attention of every retail and institutional investor and creating a wave of FOMO (Fear of Missing Out). However, with its recent peak, it has activated the sellers, creating significant selling pressure on the token, and leading to a crypto market drop.

Bitcoin has officially made a new all-time high, scraping as high as $93,850 on Coinbase at the time of this writing. Whale transactions and retail FOMO may make the short-term price action unpredictable, but the long-term indicators for BTC (and therefore, crypto) look quite… pic.twitter.com/Ae5qtdU8QN

— Santiment (@santimentfeed) November 19, 2024

2. NVIDIA Earning Report Sending Ripple In Crypto Market

NVIDIA, the AI Chip Giant, is due for its quarterly earnings report later this week, which is creating a little turbulence in the financial markets, including crypto. Major analysts have anticipated the earnings to come around 87.5% and revenue to $33.13 billion after an 83% surge. Considering its current popularity and stock performance, it is likely to come closer to the expectation. However, there are many concerns over the long-term growth perspective, as such extraordinary growth creates doubts about sustainability.

Its role in the AI and gaming industry affects the cryptocurrency market. If the tech giant fails to adhere to expectations, a sell-off in gaming and AI cryptos could impact the market’s momentum, which is also the cause of the ongoing turbulence.

3. Russia’s Nuclear Doctrine

Recently, Vladimir Putin’s approval of Russia’s nuclear doctrine has spiked people’s fears worldwide. As per the latest updates, the doctrine now has implemented provisions in responding with nuclear attacks to the nuclear power-carrying country’s conventional attack. These updates include many concerning points, but what is more concerning is that it has come amid Washington’s decision to assist Ukraine with long-range U.S. missiles against Russia. As the crypto market is sensitive to such global events, investors are stepping down from fully delving into it.

4. Middle East Geopolitical Tension

Geopolitical tension is still maintained in the Middle East despite the US efforts to civilize the situation. The recent news reports still reveal the ongoing attacks among cross-countries like Israel-Lebanon, Israel-Iran, and more. Recently, the US envoy Amos Hochstein met with the Lebanese officials in Beirut to discuss the negotiation between Israel and Hezbollah. The analysts see the possibility of progress in the cease-fire, but there is uncertainty in this case, which is affecting the financial markets.

Will the Crypto Market Back Up Anytime Soon?

The ongoing market conditions are just a part of consolidation, which has happened after its impressive performance for days now. Additionally, geopolitical incidents have caused the crypto market drop after creating short-term volatility. As a result, it is an opportunity to understand the crypto trading market and how such events could halt a successive market rally. However, such consolidation usually does not last long. More importantly, the fear and greed index still indicates an extreme greed zone among the investors, which could push it to rebuild a rally in the future. For now, the investors are watching these key events and developing their approaches against these uncontrolled situations, so it is uncertain when the market might be back.

The post What’s Driving the Crypto Market Down Today? appeared first on CoinGape.