The Ethereum (ETH) price has taken a strong lead gaining 5% over the last 24 hours and crossing past $3,500 levels while Bitcoin consolidates around $98,500. The attention shifts to ETH as BTC faces stiff resistance at the $100K milestone.

Following ETH’s gains, other altcoins like Ripple’s XRP, Cardano (ADA), Avalanche (AVAX), have reversed their trajectory for strong gains. The ETH/BTC pair will be crucial to monitor to decide the future course of action ahead.

Ethereum Futures Open Interest Hits Fresh All-Time High

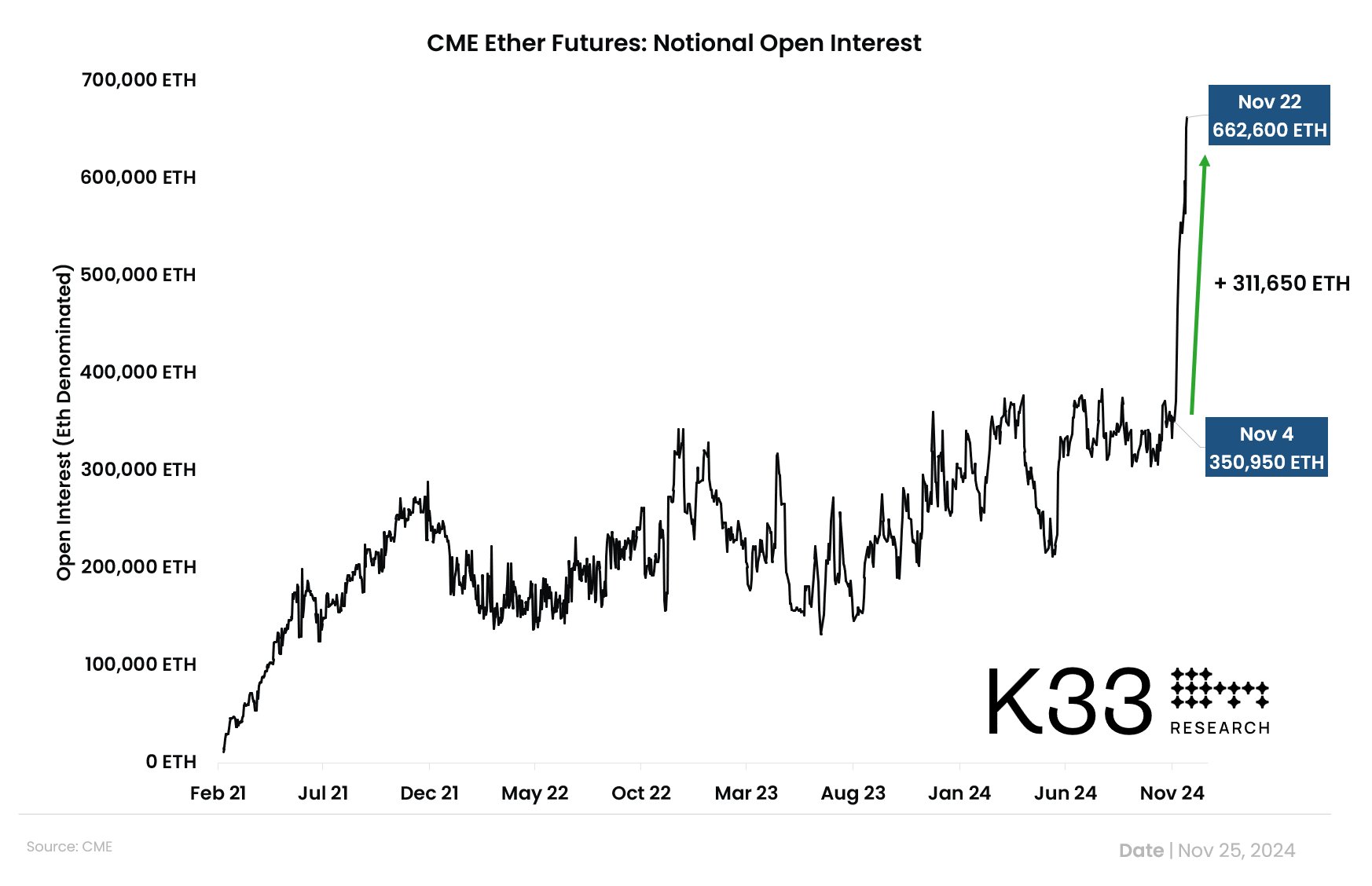

Velte Lunde, Head of Research at K33, reports that the open interest in CME’s ether futures has nearly doubled since the recent election, reaching all-time highs. For the past few days, Ether futures premiums have even surpassed those of Bitcoin. This marks a significant shift in market dynamics.

Ethereum has largely underperformed the rest of the altcoin space during the crypto market rally following Donald Trump’s victory. After surging to $3,400 earlier this month, the ETH price retraced to taking support at $3,000 levels, amid Ethereum whale dumping.

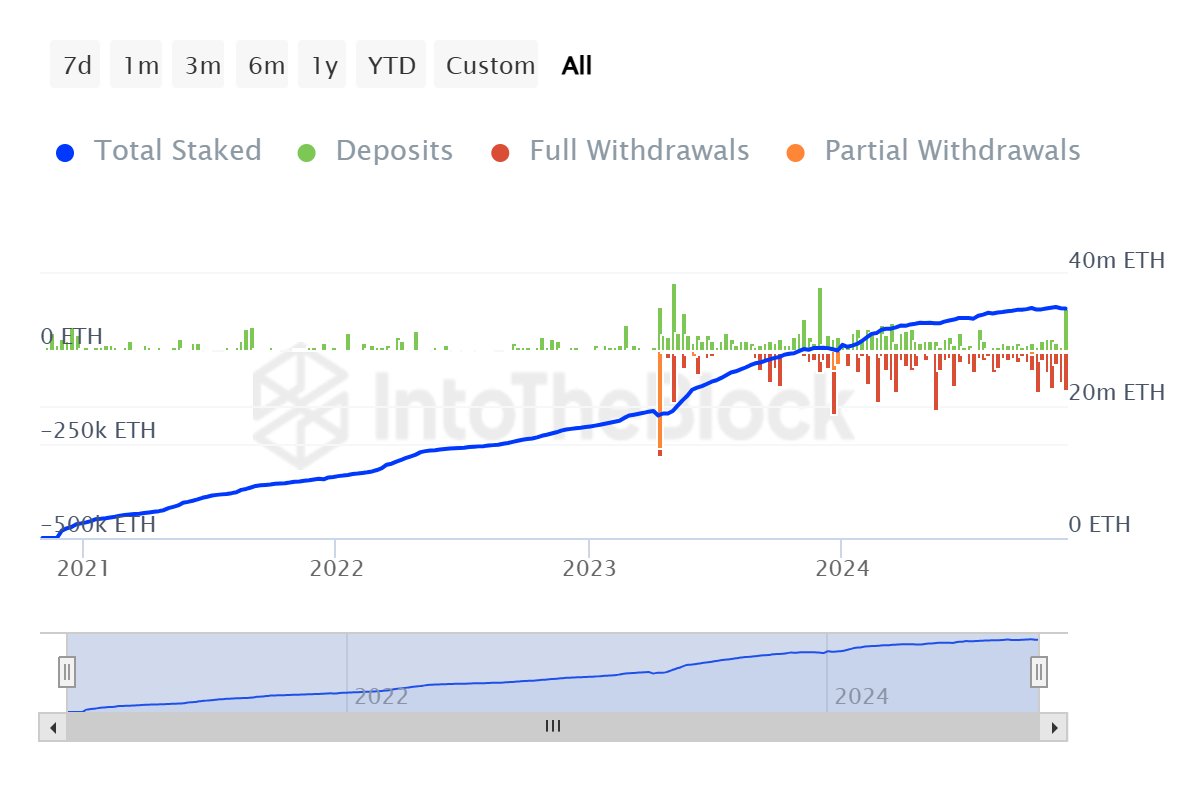

However, it bounced back from those lows jumping 14% over the past week with surging Ethereum futures open interest. Popular on-chain analyst Maartum also reported that Ether has experienced a notable change, with a net inflow of more than 10,000 ETH. A total of 115,000 ETH was deposited, while 105,000 ETH was withdrawn.

This is a much healthier and positive shift after months of net outflows. If this trend continues, it could reduce the overall availability of ETH in the market, potentially impacting price dynamics, noted the analyst.

ETH Price to Hit $10,000?

The ETH Price is showing major strength on the technical chart, overcoming the resistance of $3,375. Crypto analysts and participants consider $4,000 as the first target for Ethereum. Meanwhile, notable analysts have also shared targets of $6,500 by the end of Q2 2025.

As per the Coinglass data, the Ether open interests surged by 5.74% to $21.73 billion. Also, the 24-hour liquidations have shot up to $47.5 million of which $24.47 million are in short liquidations and $23 million in long liquidations.

Also, crypto analyst Michael van de Poppe noted that ETH price is yet to break upwards, highlighting the need for the cryptocurrency to surpass a critical resistance level. According to him, ETH/BTC must break the 0.036 mark and convert it into support before a potential upward move. Once this happens, Ethereum price rally to $10K will kickstart soon.

#Ethereum didn’t break upwards yet.

It needs to break 0.036 BTC and flip that level for support.

Once that happens, I’m assuming that the #Altcoins will go way higher. pic.twitter.com/A8R2HKj1qw

— Michaël van de Poppe (@CryptoMichNL) November 25, 2024

The post Why Is Ethereum Up Today? Will It Hit $10,000? appeared first on CoinGape.