Chainlink grabbed headlines with a 10% rally last week, which pushed its monthly gains to 53%. This stellar performance by LINK has resulted in a bullish outlook for the Oracle token. As a result, investors are expecting a massive rally for the token. One analyst, however, mentions that Chainlink price could hit $100 this bull run.

Chainlink price has recently grabbed headlines, with a 10% rise in the last week, bringing its monthly gains to over 53% as of this writing. Besides the Bitcoin factor, LINK’s upsurge has primarily been characterized by increased cross-chain integration. The crypto coin broke out of the $13.00 resistance level ten days ago, building a strong momentum for the upside.

Why Chainlink Price Could Hit $100 This Bull Run

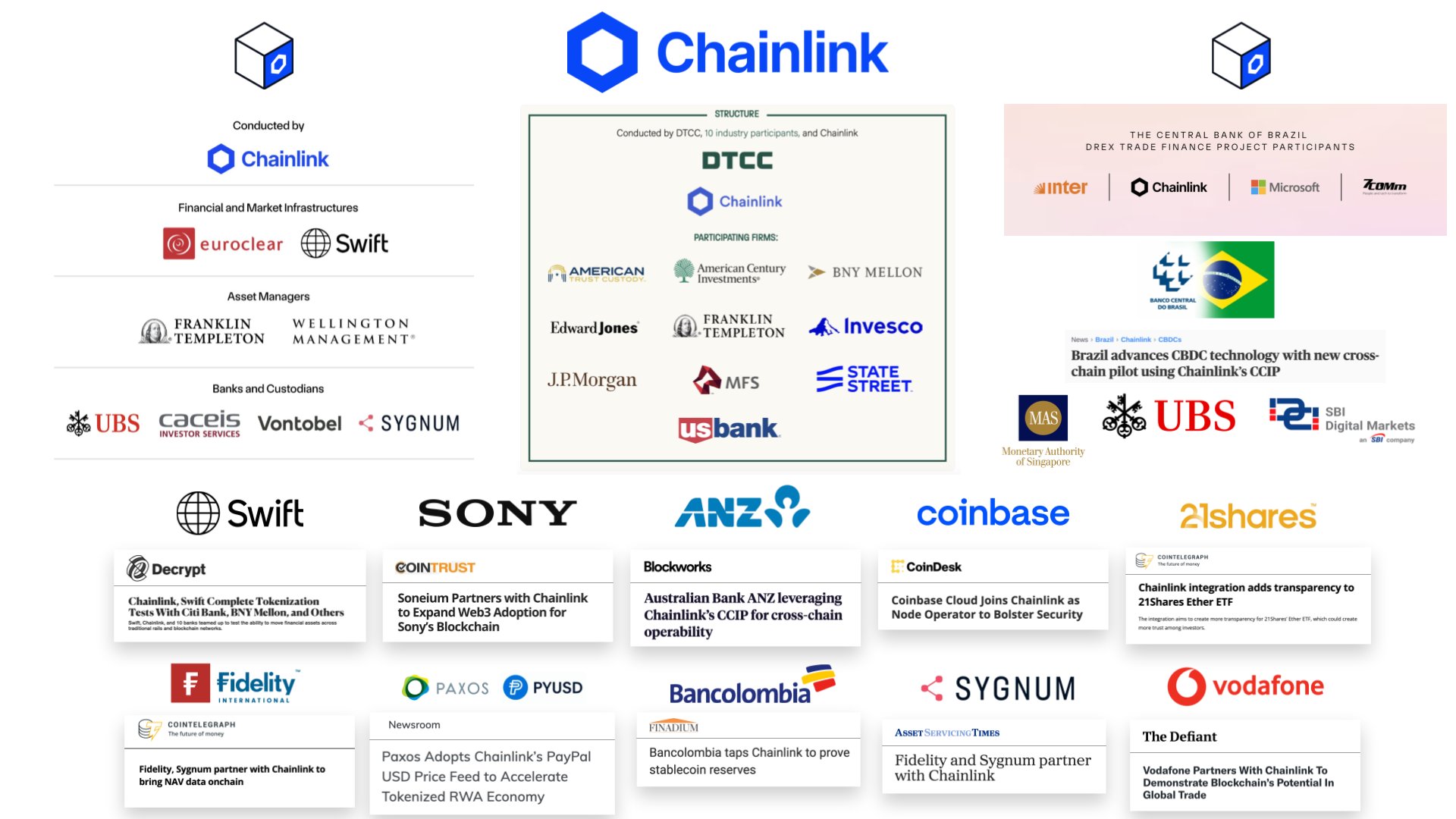

Influential market analyst Lucky, whose X account has more than 2.2 million followers, is among those who are upbeat about Chainlink price upside. On his part, he cites rising institutional adoption as a key driving factor behind his bullishness.

$LINK on fire, up 80% and institutions adopting now!

With all this adoption, $LINK to $100 seems like a no-brainer.

What’s your target for @chainlink? pic.twitter.com/ApoYVaJ1wp

— Lucky (@LLuciano_BTC) November 25, 2024

Chainlink has been aggressively integrating on-chain finance into a single internet of contracts. It has onboarded leading financial institutions like Sygnum Bank, Fidelity, Citi, UBS, and BNP Paribas, among others, in bridging the gap between DeFi and Traditional Finance (TradFi). Also, in the last week, Chainlink completed eight integrations, including Arbitrum, Ethereum, Bitcoin, Base, and Astar blockchains. These integrations will likely trigger substantial utility for LINK, which could fuel LINK price rally to the $100 mark.

A notable adoption of Chainlink is the recently announced partnership with World Liberty Financial (WLF), a crypto-focused institution backed by President-elect Donald Trump. WLF aims to scale DeFi’s use in the mainstream financial system, and it recently received a $30 million investment injection from Tron founder Justin Sun. With Trump coming into office, a looser regulatory regime in the financial sector could open up DeFi to greater adoption and help spur Chainlink price to the triple-digit territory.

Inevitable. https://t.co/0ZlXPwjTGU pic.twitter.com/7LLVEkH5r0

— Chainlink (@chainlink) November 14, 2024

LINK Price Analysis: Short-term Outlook Hints at 11% Rally

The weekly chart shows Chainlink price is contending with a resistance confluence made up of a declining trend line connecting the swing highs formed since 2021 and the horizontal hurdle at $16,73; the recent uptrend is retesting this confluence and poses a make-or-break event. Due to the recent Bitcoin sell-off, there might be a pause in the uptrend.

However, the weekly RSI seems to have found support around the 50 mean level and shows signs of resuscitating the uptrend. A breakout above the $16.73 resistance level will signal the start of an uptrend. In that case, LINK could target these levels:

- 50% Fibonacci Retracement Level at $28.28

- 100% Fibonacci Retracement Level at $53.00

- 161.8% Fibonacci Retracement Level at $82.81

- 261.8% Fibonacci Retracement Level at $131.05

The $28.28 resistance level could pose issues, and LINK could consolidate here before Chainlink price prediction hints at a swift move to the key psychological levels of $50 and $100.

Conversely, crossing below the mean 50 mark could trigger an extended decline, with a correction to the intermediate support at $12.53. A break below that mark could invalidate the upside thesis and send the price lower to tag $9.39.

The post Here’s Why $100 Chainlink Price Target is “No Brainer” appeared first on CoinGape.