Bitcoin price has bounced back once resuming rally to $100K again amid strong investor sentiment this Thanksgiving. The BTC demand growth shows a healthy uptick suggesting that bulls are active after the recent pullback. Furthermore, the announcement of an interest rate cut by the Bank of Korea on Thursday has fueled market optimism.

Bitcoin Price Rally to $100K After Interest Rate Cuts

Earlier today, the BTC price bounced back gaining another 3.6% in the last 24 hours, and currently trading at $95,538. This coupled with the South Korean Central Bank announcing interest rate cuts for the second time this year, has brought renewed optimism for $100K levels.

CryptoQuant head of research Julio Moreno stated that the Bitcoin price is preparing for a Thanksgiving rally to $100K.

$100k by Thanksgiving day.

— Julio Moreno (@jjcmoreno) November 28, 2024

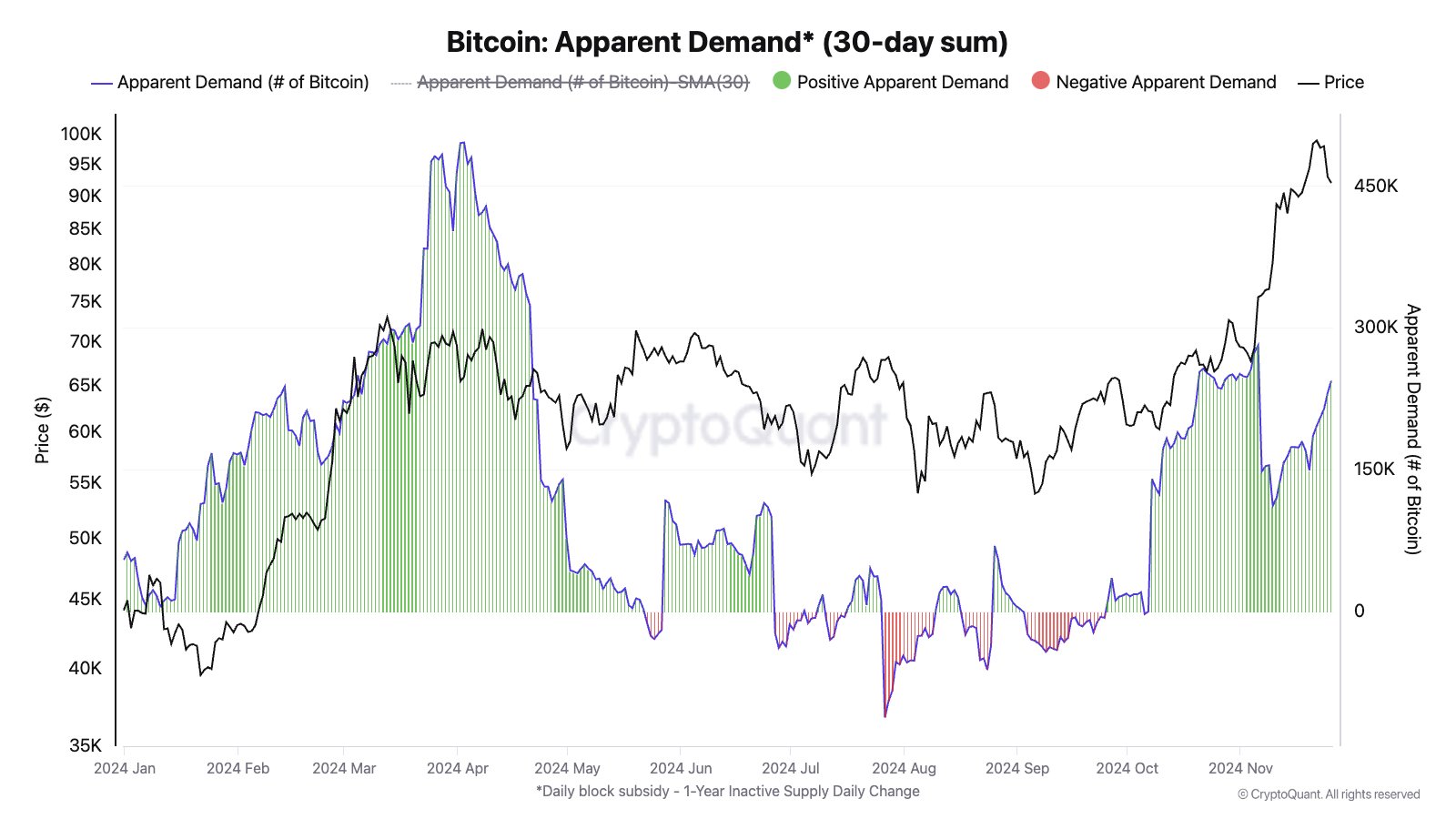

Moreno further highlighted a renewed surge in Bitcoin demand following its recent price pullback. “Demand expansion is what will drive Bitcoin higher,” he stated, emphasizing the critical role of increasing interest and market activity in fueling further price gains. The uptick in demand suggests positive momentum for Bitcoin as it stabilizes after the correction.

In an unexpected move, the Bank of Korea’s monetary policy committee lowered its key interest rate by 25 basis points to 3% during a rate-setting meeting in Seoul, on Thursday, November 28. This could also mean a fresh influx of capital in the market thereby allowing South Korean crypto investors to buy more Bitcoin and altcoins.

However, the top South Korean exchange Upbit has been recently facing a probe over KYC violations. The Financial Intelligence Unit (FIU) uncovered more than 500,000 instances of improper customer verification.

BTC Rally Impacts South Korea Stocks

Following the Donald Trump victory in early November, the Bitcoin price has rallied all the way to $100K levels surging over 35% in less than a month’s time. This rally has had a major impact on South Korean equities, especially the small-cap stocks.

While Bitcoin rallied 35% over the past month, the small cap-dominated Kosdaq Index has dropped 8%, making it Asis’s worst-performing index in 2024. Some market analysts believe that this is because small investors are selling their shares in favor of Bitcoin.

The shift underscores a growing concern for policymakers in South Korea, where cryptocurrency trading volumes on local exchanges have now surpassed those of the benchmark Kospi stock index.

South Korean regulators have hesitated to approve Bitcoin exchange-traded funds (ETFs), citing fears of capital outflows from the domestic stock market. However, this has pushed South Korean crypto investors to take leveraged crypto bets.

“Because the Kosdaq market is doing terribly, people are heading to the coin market,” said Ahn Hyunsang, chief executive of the Korea Investment Research Institute, to Bloomberg.

The post Bitcoin Price To Hit $100K As South Korea Announces Rate Cuts? appeared first on CoinGape.