China’s dominance over the U.S. in terms of shipbuilding is sending alarms through Capitol Hill, forthcoming legislation suggests.

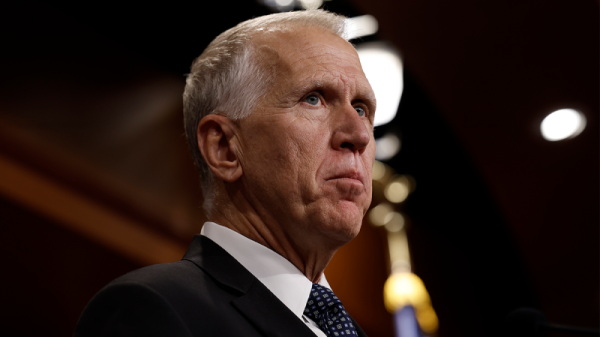

A bipartisan group of military veterans now serving in the House of Representatives – Homeland Security Committee Chair Mark Green, R-Tenn., Rep. Jen Kiggans, R-Va., and Rep. Don Davis, D-N.C. – are rolling out a bill aimed at revitalizing the flailing U.S. commercial ship sector.

‘This is no drill. A fundamental pillar of America’s security, our naval supremacy, is under threat from Communist China,’ Green told Fox News Digital.

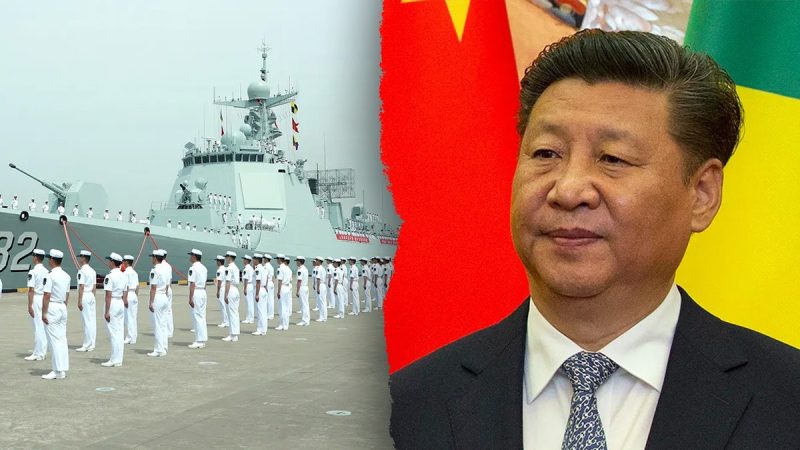

Green said China’s Navy was now the largest in the world, surpassing the U.S. with 350 estimated seafaring vessels, compared to 280.

‘China has used its fleet to erode freedom of navigation, harass civilian ships, and intimidate our allies,’ he said. ‘To maintain our strategic edge, we must invest ‘full speed ahead’ in our maritime industrial base – encompassing commercial shipbuilders, military shipyards, and every link in the supply chain.’

The bill would establish a National Commission on the Maritime Industrial Base, and mandate it to launch a probe into the status of American maritime industries, both military and commercial.

The goal would be to develop policy and legislative recommendations to revitalize U.S. shipyards.

Kiggans said shipbuilding was the ‘backbone’ of her coastal Virginia district’s economy, in a statement to Fox News Digital.

‘However, due to workforce and supply chain issues, our maritime industrial base is struggling to keep pace with growing global threats. This Commission is a critical step toward identifying the challenges facing our shipyards and strengthening our ability to build and sustain a world-class fleet,’ she said.

Davis said, ‘We must collaborate to ensure that both the public and private sectors work together to find solutions that will strengthen our maritime industrial base. Shipbuilding is vital for our national security.’

U.S. competition with China has remained among the most bipartisan issues in Congress, even with the current hyper-partisan environment.

China has nearly 47% of the global market in shipbuilding, according to the U.S. Naval Institute.

South Korea and Japan are second and third, with roughly 29% and 17% of the market, respectively. The U.S. has 0.13% of the market.

A single Chinese shipbuilder managed more output by tonnage in 2024 alone than the U.S. has in its entirety since World War II, according to a report by the Center for Strategic and International Studies, which said China’s dominance in the sector was a national security risk.