LVMH is a European luxury conglomerate and a family-run group. Made of 75 different brands/houses, the group generated revenues of EUR79.2 billion and employs nearly 200 thousand people worldwide.

The stock made headlines this week as it has reached in the OTC markets a stock market value of $500 billion. It is a milestone for Europe because LVMH is the first European company to reach such a milestone.

It entered the top 10 companies ranked by market capitalization, just behind Tesla.

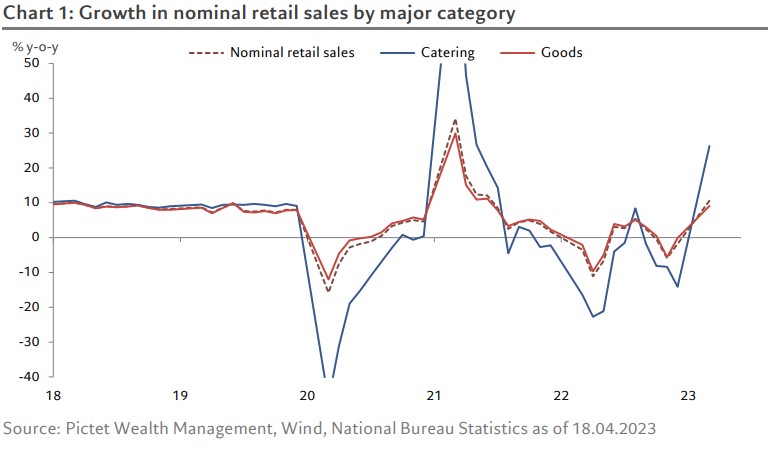

The booming sales of luxury goods in China are one of the reasons for LVMH’s performance. A strengthening euro, another. It should not be surprising as, looking at past data, one-third of global luxury sales in 2019 were made by Chinese shoppers, mostly when traveling abroad.

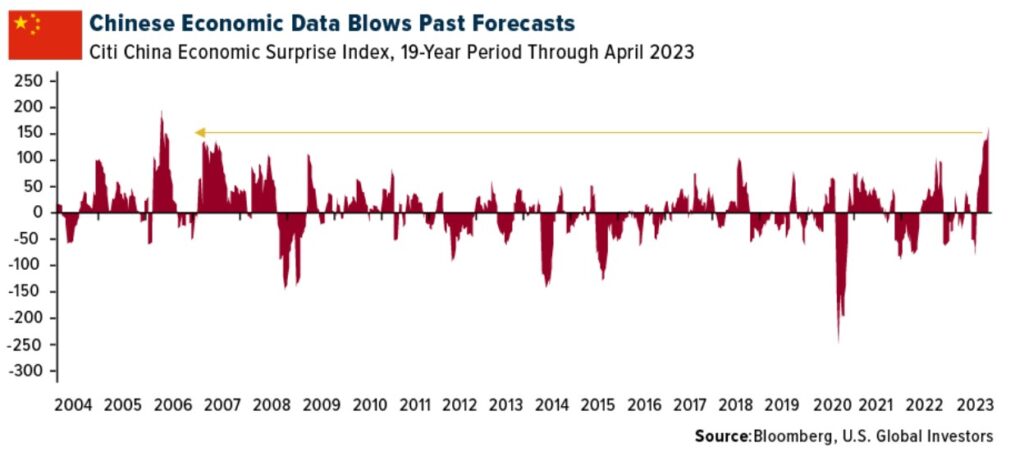

The Chinese GDP expanded by 4.5% YoY in the first quarter of 2023, surprising positively. Moreover, the main driver of growth was household consumption.

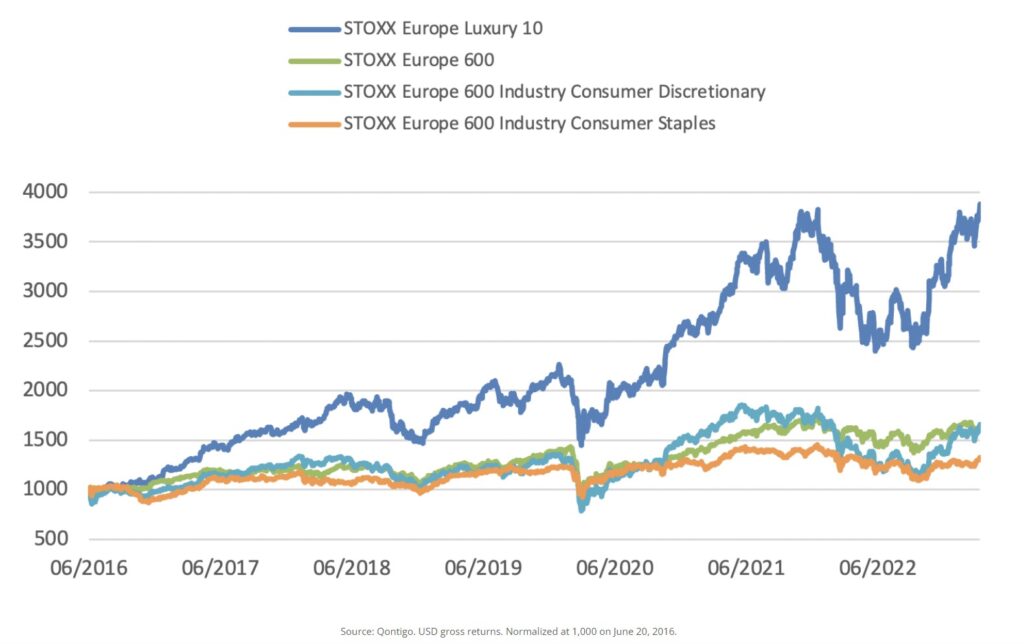

Strong returns for STOXX Europe Luxury 10 index

It is not only LVMH that outperforms, but the entire European luxury market. An index made of 10 luxury companies from Europe, such as LVMH and Hermes International from France, Ferrari from Italy or Burberry from the United Kingdom, has outperformed by far other indices in the consumer discretionary or consumer staples sectors.

The ETF is listed in Korea and not by chance. Recent studies show that Koreans are the world’s biggest consumers of personal luxury goods, spending six times more than the Chinese.

LVMH price target

Although we are only at the end of the fourth month of the year, LVMH stock is up 31.26% YTD. It gained 48.65% in the last 12 months and it trades at a P/E ratio of 32.64 over the same period.

LVMH chart by TradingView

The chart above shows the LVMH stock’s performance in the past three years. Literally, it is a bullish story.

Every consolidation since the dip in 2020 caused by the COVID-19 pandemic turned out to be a bullish pattern. The stock tripled in three years, and the round EUR1000 level looms large.

EUR800 is pivotal. A dip below breaks the bullish trend, but most likely bulls will use the opportunity to buy some more.

All in all, LVMH is a bullish story in a rising industry.

The post LVMH price target after surpassing $500 billion in market value appeared first on Invezz.